How Supply Chain Financial Management Can Reduce Costs and Improve Cash Flow

Supply Chain Financial Management

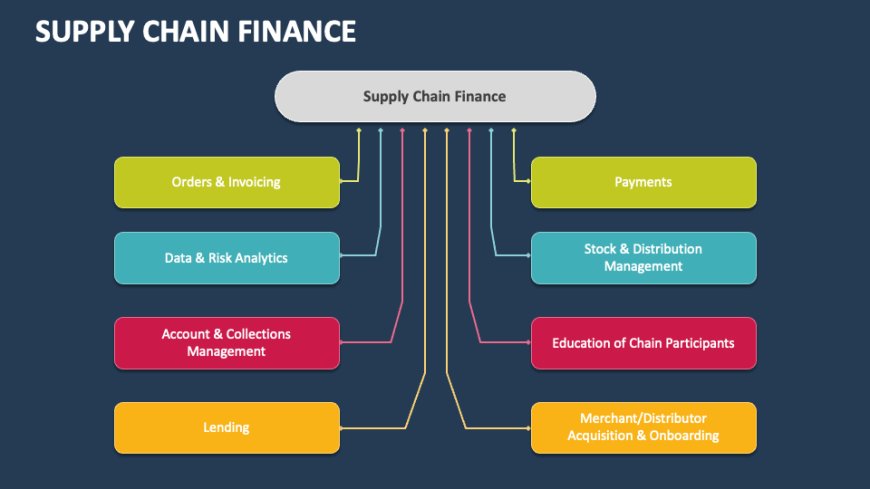

In the modern competitive business environment where a business thrives on margin, cash flow management will be as significant as any escalation of sales. Companies in India are seeking viable methods of reducing expenses, liberating current assets, and remaining economically nimble. This is where the supply chain financial management is playing vital role. The merging of both finance and supply chain operations will help companies to unlock a greater level of liquidity, streamline processes, and create a stronger, more reliable business relationship.

Understanding the Real Cost Pressures in Supply Chains

Most companies are experiencing financial problems that are not visible at first glance. Lengthy payment cycles, slow receivables, large inventories, and high short-term borrowing silently put pressure on the cash flow- particularly among the MSMEs with low working capital. When funds are stuck in unpaid invoices or stock items that have not been sold, the businesses are in a situation where they must take out high-interest loans, which decreases overall profitability.

A systematic financial strategy of supply chain management assists in dealing directly with these issues and creating clarity, control, and consistency in cash movement.

Reducing Costs ThroughSmarter Financial Integration

Once finance is effectively incorporated into the supply chain operation, cost savings follow naturally:

The receivables are turned into expected cash flow, thereby minimizing reliance on expensive borrowing.

Improved invoice, approval, and payment visibility reduces errors and administration.

Automated operations save time and operational expenses through the elimination of manual reconciliation.

Prepaid suppliers assist in acquiring favourable prices and enhancing the total cost efficiency.

This smarter integration turns everyday transactions into prospects for financial optimisation.

Improving Cash Flow Without Disrupting Operations

Supply chain-focused financial solutions help improve liquidity without interrupting daily business activities. On-time payments help suppliers in production planning, managing inventory, and meeting demand confidently. Also, the buyers can optimise payment cycles with no pressure on relationships.

Digital platforms and supply chain finance providers in India offer invoice-backed financing linked to real trade transactions. These solutions are less risky, faster in disbursement and often more flexible than the conventional credit options.

Building Stronger Supplier Relationships and Business Stability

Healthy partnerships are the result of healthy cash flow. Financially stable suppliers are more dependable, quicker, and dedicated to long-term cooperation. This stability reduces time risk, inconveniences and poor quality, saving businesses money, time, and reputation.

A supply chain thats well managed is a strategic benefit over time, making it possible to scale faster and become more responsive to changes in the market.

A Strategic Edge for Indian Businesses

With the increasing adoption of digital and the transformation of financial structures, structured supply chain solutions are becoming more popular among Indian businesses. Collaboration with skilled supply chain finance providers in India offers companies the opportunity to access transparent, compliant, and scalable funding structures that are pitched towards sustainable expansion.

Finally, it is not only about the short-term cash solution, but also about supply chain financial management. It is a long-term plan to save money, enhance the cash flow and develop strong and future-focused businesses.

Grow Smarter With GSC Support Fund

Whether you are an MSME or an established enterprise, GSC Support Fund helps with simple, structured, and growth-focused financial solutions.

Unlock working capital, reduce financial pressure, and strengthen supply chain stability. Power your business growth with the GSC Support Fund.