Credit Balance Services

Credit Balance Services | Financial Accuracy & Compliance Learn how professional credit balance services ensure accurate accounts, compliance, and operational efficiency while reducing financial risk.

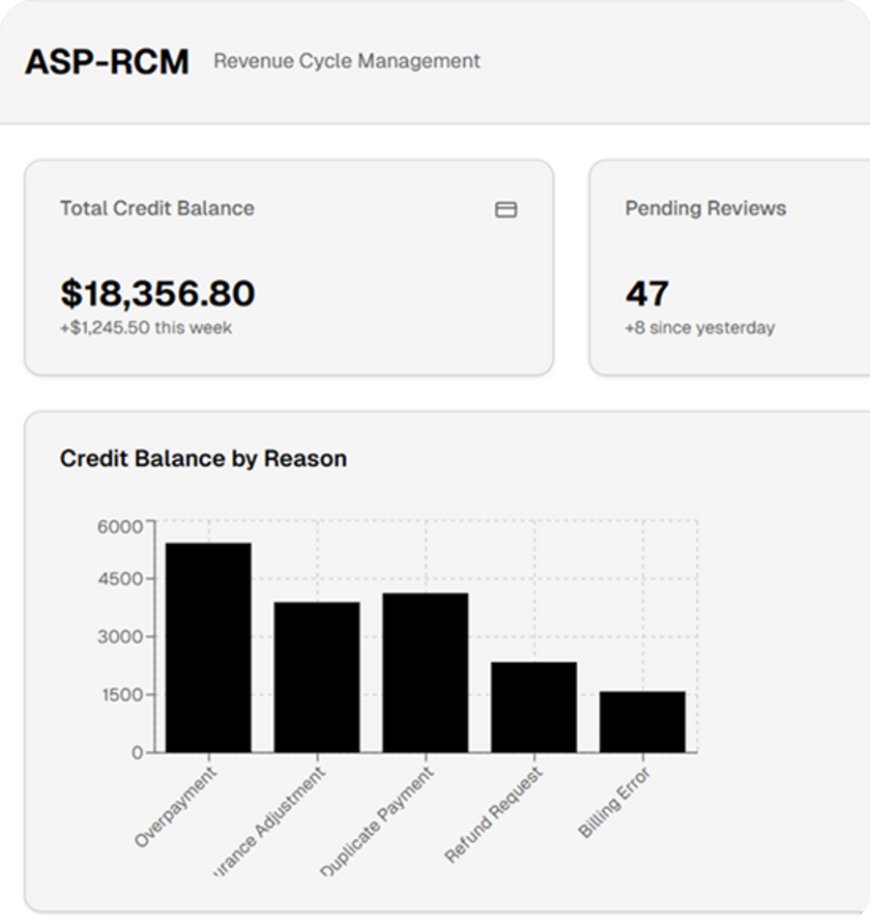

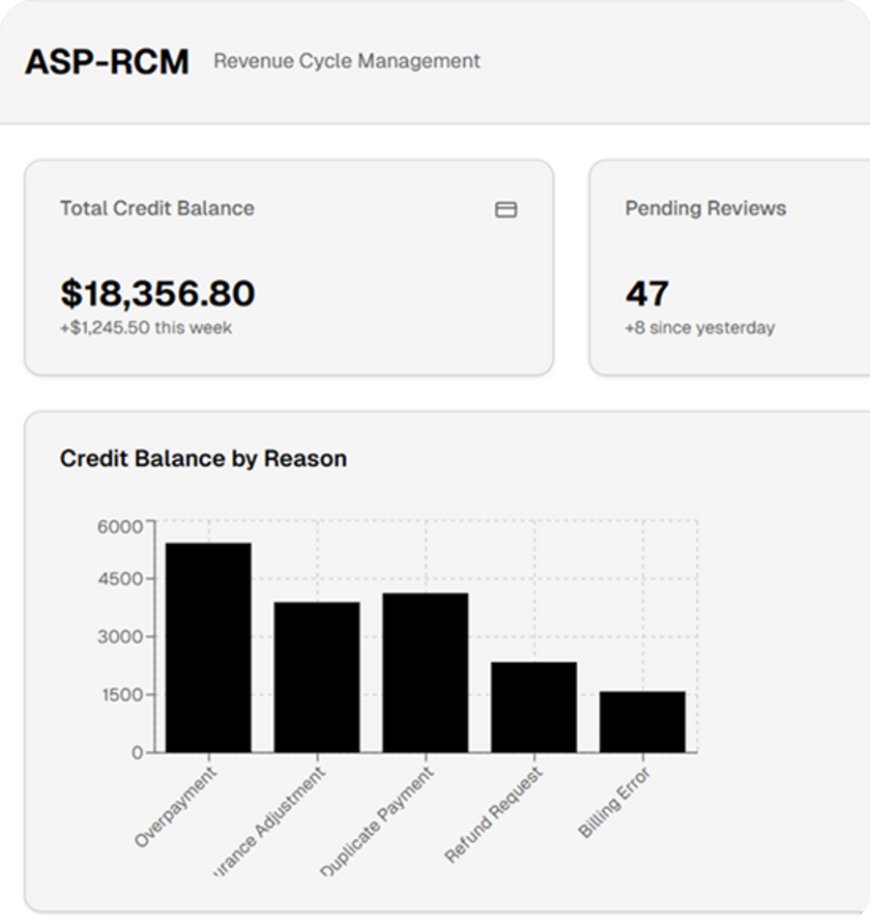

Credit balancesoverpayments made by clients, insurers, or other payersare a common yet often overlooked challenge for organizations. When not managed effectively, these balances can disrupt cash flow, create compliance risks, and reduce operational efficiency. Professional credit balance services provide the expertise and processes necessary to identify, reconcile, and prevent these financial discrepancies.

What Are Credit Balances?

A credit balance occurs when a payment exceeds the amount owed. Common causes include:

-

Duplicate payments

-

Billing errors

-

Adjustments or refunds

-

Misapplied payments

Left unresolved, credit balances can accumulate, complicating financial reporting, increasing audit risks, and affecting organizational decision-making.

Why Managing Credit Balances Matters

-

Financial Accuracy: Properly reconciling credit balances ensures accurate accounts and reporting.

-

Regulatory Compliance: Unresolved overpayments can lead to penalties or audits.

-

Operational Efficiency: Streamlined processes save time for finance teams.

-

Risk Reduction: Detecting and correcting errors reduces financial exposure.

Best Practices for Credit Balance Management

-

Regular Account Audits: Frequent reviews help detect overpayments early.

-

Automated Reconciliation: Leveraging technology minimizes manual errors and speeds up the process.

-

Clear Policies & Procedures: Establish standardized guidelines for handling overpayments and refunds.

-

Staff Education: Equip your team with knowledge about common errors and resolution methods.

-

Proactive Prevention: Analyze recurring issues to prevent future credit balances.

The Role of Professional Services

Outsourcing or partnering with professional credit balance services ensures thorough, accurate management of overpayments. Experts can:

-

Perform detailed account reviews

-

Reconcile accounts quickly and accurately

-

Provide actionable reporting

-

Educate internal teams for long-term efficiency

By integrating these services, organizations can focus on their core operations without worrying about unresolved financial discrepancies.

Conclusion

Effective credit balance management is essential for financial stability, compliance, and operational efficiency. Implementing best practices and leveraging professional expertise helps organizations maintain accurate accounts, reduce risk, and create a smoother financial workflow.